How to Manage Your Construction Loan

You closed the construction loan, but how do you get the money?

At the closing of your construction loan, the only money normally loaned the first day is to pay off the lot loan. This is called an advance for the lot. Other than that, even though you leave the closing table (usually the lawyer's office) with signed loan and mortgage documents, you haven't actually borrowed any money.

Based on the appraisal and bank limits, your loan documents will show the amount of the loan, which is the amount of money you can borrow from the bank to build your house. You can only borrow money on this loan as you make actual progress on the construction.

When you start building your home, the first payments you make will have to come mostly or completely from your own funds. You pay interest only on the money you draw off the loan, so you actually save by starting your loan "draws" after you have made some progress on the house.

The money from the loans will be available in increments as you make measurable progress. You will have to ask for this money, and the bank will verify your progress.

Get Your Money When You Need It!

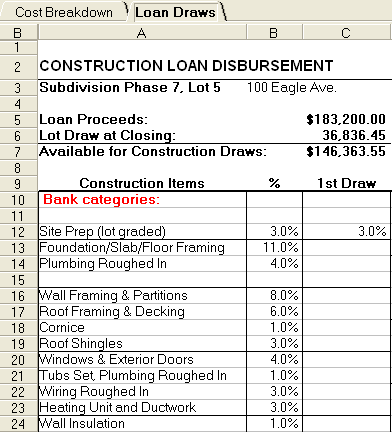

When you ask the bank for money from your construction loan, commonly called "making a draw," your request must be in keeping with the bank's Schedule of Values. Some banks want to keep this schedule to themselves, which is a ridiculous way of doing business. Your using it is vitally important to loan management and keeping track of your financial position throughout the construction process. Get this schedule from your banker!

How do I know how much construction loan money to ask for?

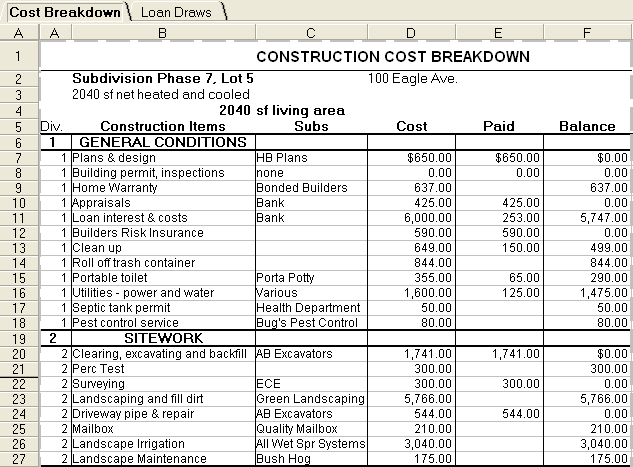

Each phase and portion of the construction process is assigned a percentage of the cost (value) of the house. When you request a bank draw, the amount requested must be within the percentage you have earned through completion of various portions of the construction. To illustrate, let's look at the portion of a sample spreadsheet below, used to track our progress. The dollar figures are shown for illustration purposes.

In this example, work has progressed through the completion of the rough sitework, and you are ready to lay out the house and batter boards. Still, there's nothing on your property but dirt and the remaining trees. The dollar amounts in the Paid column add up to $4843.

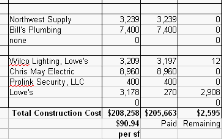

You cannot afford to be without this form! The column headings cover every construction item, its sub or supplier, its expected cost, the amount paid so far, and the amount still remaining to be paid. These columns total at the bottom of the form, to track the total expected cost, total payments, and the total amount yet to be paid. You can view the entire form at the end of this page.

On the portion of the Loan Management Form shown below, there are columns for construction items, the % (value) assigned to each item, and the percentage of completion that has actually been accomplished for each item. In our example, the Loan Proceeds, shown near the top, is reduced by the amount needed to pay off the Lot Loan , leaving $146,364 "Available for Construction Draws". The bank we are using assigns 3% as the value for completed sitework. Taking 3% of $146,364, we calculate that we can borrow, or "draw," $4391 at this time.

Calculated:

$4843

-4391

$ 452

You can't borrow enough cash to cover your current expenses, so you have to put in some of your own money. On our projects, we use as much of our own cash as practical before we draw off the loan. You don't pay interest on the loan money until you draw it, and only on the amount you have received.

We usually don't start borrowing from the construction loan until we start framing the house. However, this depends on how much cash we have available.

Follow this process all the way through the project. Always keep good, written records. Anticipate your expenses and bills a few days ahead, to avoid getting yourself into a tight spot without enough money to cover the week's expenses.

How do I get the construction loan money from the bank?

You will need a checking account with the same bank, so the bank can easily transfer your loan draws into that account. The bank will usually give you their blank forms for making draw requests. Making requests by email might be the best way for you, for these reasons:

1. Email is quick and easy.

2. You don't need a fax machine.

3. You can send an email any time of the day or night.

4. You have a clear written request.

5. Each email can be sent to the loan officer and assistant, to make sure your request gets processed.

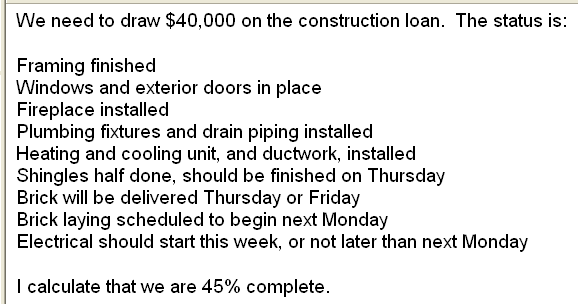

Be sure to include your account number, property address, your name and phone number on each email. I believe in giving as much information to the bank in these requests as is reasonable. It helps to inform the bank of your progress, even though they will visit your house to verify your percentage of completion. If they find your statements to be reliable and accurate, it might help you later in the process when you need some money sooner than the bank staff can put their own eyes on the project.

This is the body of an email I sent to the bank on one of our houses:

"45% complete" was calculated from the "Loan Draws" tab of the spreadsheet form we reviewed earlier on this page.

Another advantage of using email is that the bank will usually cover and waive fees for any "insufficient funds" checks, if the low balance in your checking account was due to their failing to get the bank draw transferred in a timely manner.

Try to request construction loan funds at least two days before you need the money, or more in advance if that is the bank's policy. You will develop a good reputation with the bank, as someone who takes care of business in a way that doesn't put them in a bind. Remember that they may have to send someone out to visit the house and verify the degree of completion before they can give you the loan advance (money). You also want to develop a reputation among your subcontractors and suppliers as one who pays promptly and writes valid checks. This requires money in the bank, so spend the time you need to keep track of your finances and manage your loan!

How often can I get the money from the bank?

That depends on the bank's policy. We have dealt with banks that wanted to stick with only three or four draws throughout the entire process! You will need a lot more cash to operate this way and still pay your subs and suppliers promptly.

Other banks allow us to make as many draws as we need, even weekly. You will enjoy the house building process much more with this arrangement, because it lessens your concerns over having enough money when you need it. Ask the bank about its policy on loan draws!

We wish you all the best!

View the entire Construction Cost and Loan Draw forms. (Opens a new window.)

Return from Construction Loan Management page to Building Loans page.

Comments

Have your say about what you just read! Leave us a comment or question in the box below.