Builders Risk Insurance -

Don't Get Caught Without It

You will have to get a Builders Risk Insurance Policy to close the construction loan with the bank for your new home. Even if you don't need a loan to build your house, you still need this insurance.

It covers losses due to theft of materials and damage to the house and its materials during construction. It is not liability insurance. (Some companies may offer liability insurance as part of the policy for an additional premium.)

As with everything on your home building project, do your homework and get your facts from people in the business (those who know). Remember to get the insurance even if you are paying cash. The cost of having the insurance coverage is small compared to the potential financial losses that can occur during the building of your home.

At the end of this page, you can read about the lightning damage that was covered by the builder's risk policy.

What does a Builder's Risk Insurance policy cover?

Always read your policy carefully to know for sure. Coverage usually includes:

- Materials that have been installed or are to be installed.

- Outdoor paving, curbs, fences and fixtures that are built as part of the project.

- Landscaping materials that are purchased and installed as part of the project.

- Collapse of the structure, due to a variety of causes.

- Scaffolding, concrete forms and other temporary items while at the house site.

- Debris removal that is associated with a covered loss.

- Water damage from some sewer or plumbing drainage problems.

What will NOT be covered by the policy?

Typically, damage to or theft of these items will not be covered by your builders risk insurance:

- Vehicles, except that materials being carried by them to the construction site may be covered.

- Portions of an existing structure (such as with an addition or renovation of your house), unless specifically endorsed on the policy.

- Tools and equipment that were not intended to be installed permanently in the house.

- Flood water or mudslide damage.

- Damage from ground water that leaks into the structure.

How do I get this insurance, and how much will it cost?

Builder's Risk Insurance is more like commercial insurance than a personal homeowner's policy, since it covers a business venture. The policy usually lasts 12 months. Many insurance companies that sell homeowner's property insurance do not offer builders risk insurance, so you will need to shop companies that do. Go with a local company if possible.

Premium rates will be based on the estimated value of the completed house, which may be calculated from the square footage of the house. Value of land is not included in the calculations. The annual premium for the last house we built was $884, based on an estimated structure replacement value of $270,000. The policy included a $1000 deductible amount. Depending on the loss you incur, the cost to get damage repaired to a house under construction may include clean up and demolition of damaged materials, plus buying new materials and building back the damaged areas.

TIP: Get the policy started only when you are ready to start building, or wait until you have to sign papers for the construction loan. When you pay for the policy, the 12 month period starts. Set up for monthly premium payments if possible, instead of paying the annual premium up front. Since you should finish your home within 4 to 7 months, you can cancel the policy when you finish since you won't need the full year's coverage (after you secure your new homeowner's insurance policy). If you pay the full year's premium up front but finish building the house in less than a year, you may be able to get a refund of unused premium, but you'll have to go through a paperwork process to get your refund.

What if we want to move furniture or people into part of the house before it's completely finished?

Absolutely not! At least, not unless you know for sure that it's okay with your policy, insurance agent, bank, and building department. Remember that the builders risk insurance covers the house during construction. It is not a homeowner's insurance policy, and you can't buy homeowner's insurance on a new house that is under construction.

There may be no coverage for a fire that breaks out after you have “moved in”. You may be covered after moving in for a period specified in the policy, but you may not. Moving in furniture, boxes or occupying the house may void the builders risk insurance. Don't take a chance on being wrong – don't assume anything. Read and ask.

Our insurance claim:

On one of the houses we built, we filed a claim with the insurance company for damages from a lightning strike. We had worked so hard to preserve a large, handsome oak tree in the back yard. When the house was completed and the grass sod was in place (ready to sell!), a strong thunderstorm came through and caused a lightning strike that exploded down both sides of the tree.

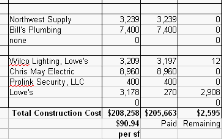

Bark was blown onto the roof 40 feet away. Lightning jumped off the tree onto the ground, and laid the sod back for 25 feet to the first set of wired irrigation valves in the ground. It then burned up the underground irrigation control wiring, and blew the control panel off the garage wall (on the opposite side of the house). The burning panel's electrical wire scorched the wall in the garage.

The repairs included complete replacement of the irrigation system wiring, house electrical work, drywall repair, and repainting of scorched walls. The builders risk insurance carried a $1000 deductible, and covered the cost of everything except the removal of the dying tree. If this had been a new tree that the landscape contractor had planted, it would have been covered.

We wish you the very best with building the home of your dreams!

Sincerely,

Vic & Susan Hunt

Leave Builders Risk Insurance and go to the Project Managing and Planning page.

Comments

Have your say about what you just read! Leave us a comment or question in the box below.