Cash, Construction Loan, and Mortgage

As house prices rise, building your own home can become more attractive.

A construction loan and other financing issues are some of the first hurdles you will face, unless you have all the money you need in your bank account.

Here are some basic steps involved in financing a new home that you build:

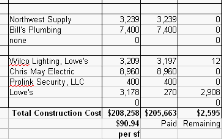

1. Determine the realistic expected cost of the complete project.

2. If you have the cash in the bank, congratulations! You don't need to read any further.

3. Visit a banker and mortgage company as needed to set up the necessary loans.

4. Obtain the property, using a lot loan if necessary.

5. Obtain a construction loan, which will cover a portion of the home's cost.

6. Obtain a home mortgage loan after the construction is complete. You may have to go to more than one bank to get your loans!

We had to get bank financing in order to start building homes. We visited a friend from our church who was a vice president at a local bank. We had a great meeting and gave him all of the information needed by the bank. We waited and waited, and nothing happened.

Another banker had helped some friends with business loans, so we visited him at his bank. We had another great meeting, ending with his promise to call us within a week.

Well, 10 days went by and we didn't hear from the second banker, so I called him. He said the bank had all the money tied up in construction loans that they wanted, and that they weren't going to lend to new builders like us.

Two or three weeks later, the first banker we had met with called to say that we were approved! (This bank wanted to increase the number of construction loans on its books.) We had been discouraged, and assumed that they wouldn't work with us either. They agreed to start us with one house. They were anxious for us to get going, which we did immediately. Each bank has its unique situation, so present yourself to as many as it takes. Don't give up!

A good banker can be one of your best and most valuable assets, assisting you in making it financially possible to build. The bank's chief concerns are:

1. That you are financially capable of supporting building loans and their monthly interest payments,

2. That you have a good grasp of the expected cost,

3. That you are a reasonable risk to engage in building your own home,

4. That you have a system to control the cost to build a home, and

5. That you can qualify for an adequate home mortgage loan when you finish the house.

Make no mistake about it - unless you have the cash, you cannot build a house without the support of a local bank. And perish the thought that you get construction financing and build the house, but then can't get a home mortgage loan. In that case, you would have to get a second mortgage or be faced with having to sell the home to get out from under the construction loan. It does happen, so spend adequate time with the bank and mortgage company. You don't want any bad surprises.

Explore this section of our web site for the advice and information you need to handle the home cost and financing. Whatever you do, don't jump in and start building your house without finalizing the financing arrangements, even if you won't need construction loan funds until later in the project. Don't hang yourself by assuming that those details will all work out.

Click on the links above for more about each type of loan. We wish you the best!

Comments

Have your say about what you just read! Leave us a comment or question in the box below.